Top 10 Tax-Saving Hacks Every Investor Should Know

Taxes are the financial labyrinth most of us dread navigating, especially regarding our investments. It's that time of year when you start sifting through a seemingly endless pile of paperwork, decoding cryptic tax forms, and wondering if there's a better way to handle the annual fiscal headache. Take heart, though, because you're not alone in this maze of numbers and rules.

Many investors, from beginners to seasoned pros, grapple with the same questions and concerns. But fear not! In this article, we're about to unveil a collection of tax-saving hacks that are incredibly effective and surprisingly simple. So, fasten your seatbelt because we're about to reveal some hacks to keep more of your hard-earned money securely tucked in your pocket.

1. Invest in Tax-Efficient Funds

Investing can be complicated, but one way to simplify your tax situation is by choosing the right investment vehicles. Tax-efficient funds, such as index and Exchange-Traded Funds (ETFs), are a great choice. Why? Because they have a superpower called "low turnover."

In plain English, this means they don't buy and sell stocks frequently, which leads to fewer taxable events. When you buy and hold these funds, you'll have fewer capital gains to worry about when tax season rolls around. Less tax hassle equals more money in your pocket!

2. Hold on for Over a Year

Do you know how they say, "Good things come to those who wait"? Well, it's true for taxes, too! If you're patient and hold onto your investments for over a year, you can qualify for a lower capital gains tax rate.

In most cases, the tax rate for long-term gains is significantly lower than that for short-term gains. So, resist the urge to make quick trades and let your investments marinate. Your wallet will thank you come tax time.

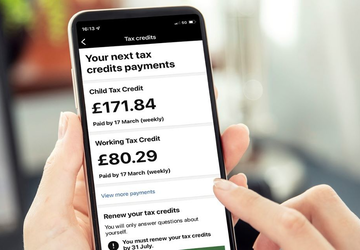

3. Use Tax-Advantaged Accounts

Tax-advantaged accounts are like the superheroes of the investing world. They're designed to help you save on taxes while building your nest egg. Take 401(k)s and IRAs, for example. When you contribute to these accounts, you might get a tax deduction.

Plus, the money you invest grows tax-free until you withdraw it in retirement. It's like getting a two-for-one deal on tax savings! Just remember, these accounts have rules and limits, so make sure you understand them to maximize your benefits.

4. Tax-Loss Harvesting

Let's break down tax-loss harvesting into simple terms. Imagine you have a garden with both blooming flowers and wilting plants. Tax-loss harvesting is like plucking the wilting plants to help your garden thrive.

In the investment world, it means selling investments that have lost value to offset gains in your portfolio. This reduces your overall taxable income. So, don't be afraid to trim the financial deadwood from your portfolio—it's a smart way to save on taxes.

5. Gift Wisely

We all like to be generous, especially when it comes to family and friends. But did you know that gifts can have tax implications? As of my last update in September 2021, you can gift up to $15,000 per person without triggering a gift tax.

This means you can share the wealth without worrying about Uncle Sam taking a chunk of it. Remember that tax rules can change, so checking the latest figures before playing Santa is a good idea.

6. Diversify for Tax Efficiency

Diversification isn't just a fancy term; it's a smart strategy for investors. When you diversify your portfolio by owning different types of investments, you can balance out gains and losses. This can help reduce your overall tax bill. Think of it as spreading your financial risk and tax benefits. It's like having a diversified tax savings plan!

7. Avoid Frequent Trading

Trading stocks frequently can be exciting but can also lead to higher taxes. Here's the deal: When you buy and sell investments quickly, gains are usually taxed at your regular income tax rate. This rate can be steep, especially in a higher tax bracket. So, before you make that impulse trade, consider the tax consequences—it might make you think twice.

8. Keep Records

Think of keeping records as building a solid foundation for your financial house. When tax time comes around, you'll want to have detailed records of your investments. This includes the price you paid when you bought them, the price you sold them for, and any dividends you reinvested. Having this information at your fingertips will make it much easier to accurately report your gains and losses. No more scrambling for paperwork at the last minute!

9. Know Your Tax Credits

Tax credits are like magical coupons that can lower your tax bill. Different investments may qualify for specific tax credits. For example, investments in renewable energy or small businesses might make you eligible for special tax credits.

These credits can significantly reduce your tax liability, so don't miss out on potential savings. Take the time to explore which credits apply to your investments and make the most of them.

10. Stay Informed

In the ever-evolving world of finance, knowledge is power. Tax laws can change, and staying informed about these changes is crucial. You don't need to become a tax expert, but following reputable financial news sources or consulting a tax professional can help you stay in the know. Knowing the latest tax regulations can empower you to adjust your investment strategy to maximize your tax savings and financial growth.

Wrapping It Up!

Navigating the world of taxes and investments doesn't have to be daunting. These ten tax-saving hacks are your roadmap to keeping more of your hard-earned money. Remember, you don't need to be a financial guru to save on taxes. Just a little knowledge and some smart strategies can make a big difference.

So, put these hacks into action and watch your tax bill shrink while your investment portfolio grows. Happy investing, and happy saving!